Geely is now the 14th biggest car manufacturer in the world – how?

We chart the Chinese company’s path to becoming one of the world’s biggest car makers

Few car manufacturers have risen so far in such a short space of time as Geely. The Chinese brand’s name can be translated from Mandarin as ‘auspicious’ and ‘lucky’. Both are entirely appropriate terms for a company founded as recently as 1986 that is now breathing down the necks of the world’s top 10 car makers.

Its origins were understandably humble. China was a vastly different country in the early 1980s when founder Li Shufu graduated from university; a hard-line communist state where free enterprise was largely banned and the small number of cars were almost entirely imported. As late as 1985, China’s domestic manufacturers produced just 5200 cars, the entire market for passenger vehicles being around 100,000 a year.

Small beginnings

Li didn’t start with cars. After making money by taking photographs for tourists, he established a small company in Zhejiang to make fridge parts, then complete units. Politics intervened: Geely missed out on a licence to sell fridges so diversified into motor scooters, quickly becoming one of China’s biggest makers. But what he really wanted to do was build cars.

The first four-wheeled Geely was a strange beast. It was built in around 1995 and was clearly inspired by the contemporary round-headlight W210 Mercedes E-Class, featuring a near-identical front end but sitting on the far shorter wheelbase of the First Automobile Works-built Audi 100. It was a one-off creation using fibreglass, but it won Li attention and people wanted to order something similar. Soon afterwards he bought a majority stake in a small truck company (which had the all-important production licence) and launched the Geely HQ, a Daihatsu Charade copy wearing a very Mercedes-like radiator grille, in 1998.

Geely expanded rapidly as China’s mobility revolution triggered a huge expansion in car ownership, but it was still a minnow compared with the country’s larger car makers – in 2003, total production was just 76,274 units. While other manufacturers were expanding through joint ventures with overseas firms, bringing expertise and helping to produce cars that Chinese buyers wanted, Li vowed to grow Geely differently, saying such arrangements created complacency and stifled innovation.

Joining the world stage

The 2005 Frankfurt motor show was packed with premieres that fought for attention, the list of debutants including the Audi Q7, Porsche Cayman S, Mercedes-Benz R-Class, five-cylinder Ford Focus ST and Volkswagen Eos. It also marked Geely’s European debut, the company taking a small stand and introducing the little, lumpy CD coupé, surrounded by characters from the Beijing opera. This was just a year after Geely’s annual production had broken through the 100,000 barrier and the company’s products looked cheap and joyless to European eyes. (Build quality wasn’t great at the time either; in 2008, JD Power ranked Geely 36th and last among Chinese brands.)

But being the first independent Chinese car maker to attend an overseas show played well at home, making Geely look like more than just the regional manufacturer it pretty much was at the time. It was a lesson echoed in the later decision to launch the deliberately European Lynk&Co brand in China first. The company’s international outlook was growing, and it formed a joint venture with Manganese Bronze, then owners of the LTI taxi company, to make cars in Shanghai.

The big league

Outside China, only keen motor industry watchers were likely to have heard of Geely before late 2009. That changed when the company admitted it was in negotiations with Ford to buy Volvo. The sale concluded the following year, with parent company Zhejiang Geely Holding Group taking control. This means that Volvo Car Group is on the same level as Geely Auto within the corporate hierarchy, not subsidiary to it.

Despite recession-hit Ford’s enthusiasm to offload Volvo, Li had to work hard to be taken seriously as a bidder. Geely generated barely a sixth of Volvo’s revenue at the time, but it had major backing from Chinese banks and managed to land the Swedish marque for $1.8 billion, barely a quarter of what Ford had paid for it 11 years earlier.

Few industry watchers understood the logic behind the deal. Automotive mergers are normally between companies with significant overlap looking to reduce costs. Geely and Volvo had almost nothing obvious in common, and many predicted that attempts to merge operations would be disastrous. But Li didn’t want a merger, promising at the time that “Volvo is Volvo and Geely is Geely”. As it soon became clear, Geely had effectively purchased a hugely experienced European brand to become its own joint venture partner.

Swedish powerhouse

Geely’s gamble on Volvo would only work if the Swedish company’s fading fortunes could be turned around. The brand’s sales were sliding and it had been starved of investment during the last years of Ford ownership. A Volvo engineer admitted later that if a light bulb failed during this period in the Torslanda HQ, it was easier to move to one of the many empty desks than to get it replaced. The first task was to break away from shared Ford engines and architectures.

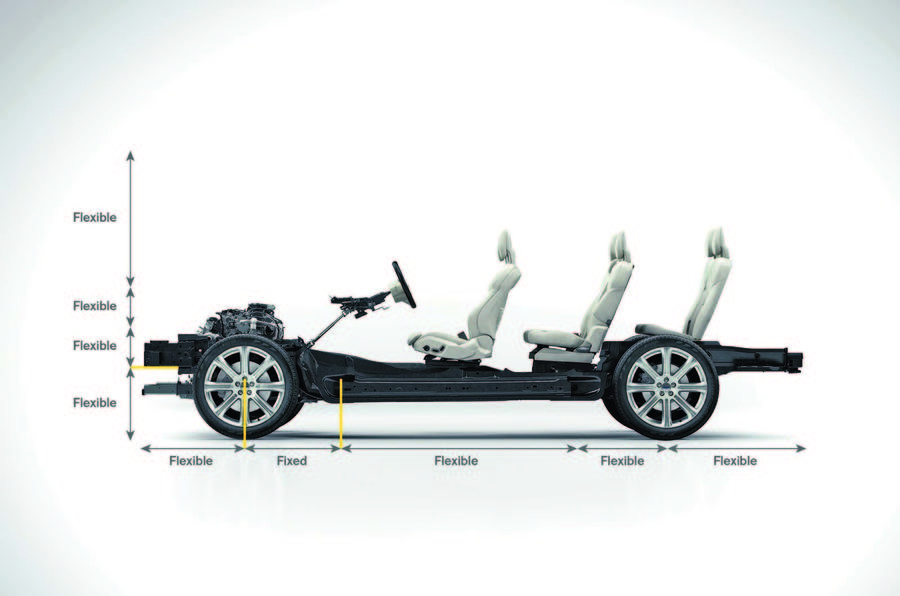

Volvo got access to much-needed funds, with loans totalling $2bn from the China Development Bank, but new CEO Håkan Samuelsson was also left to work with minimal interference. Volvo took the decision to develop a single, flexible platform – Scalable Product Architecture – to underpin replacements for all of the company’s 60, 70, 80 and 90 series products. It also opted to dramatically reduce powertrain complexity by getting rid of larger engines and using a new family of three- and four-cylinder units, with performance added through hybridisation. Sales had already started to rebound before the first SPA model, the new XC90, was launched in 2014. By last year, they were close to doubling 2009 sales, with much of the growth coming from China on the back of local production.

But SPA was too grand and expensive to underpin Geely models, leading to the establishment in 2013 of China Euro Vehicle Technology, a joint venture between Geely Auto and Volvo that has engineered the Compact Modular Architecture underpinning smaller Volvos – as well as those from what was meant to be Geely’s funky new subsidiary…

Building success

While Geely has been exporting since 2003 and sells cars in many parts of the world, including Russia, the Middle East and South America, it hadn’t cracked the EU or North America, or created a product that seemed capable of doing so. The arrival of CMA would allow Geely to create premium-feeling models, but it decided to launch a new brand to get them taken seriously.

Lynk&Co was the result, an international mix with headquarters in Gothenburg and marketing in China that played big on the European connection, but with local assembly allowing for some extremely attractive pricing. Lynk&Co will come to Europe and the US, where the plan is to offer a subscription leasing scheme and a range that will be entirely plug-in hybrid or EV. But in China it is much more traditional, with early cars only being available with conventional engines and being sold through retailers. It has been a success, with 120,414 sales in China last year helping to take Geely Auto through the 1.5 million barrier. Including Volvo and the Yuan Cheng commercial models, the group produced 2.15 million vehicles last year. Globally, Geely Group is now the world’s 13th-biggest car manufacturer, between BMW and Mazda.

Earlier this year, Geely launched another new sub-brand in China. Branded Geometry, it will offer a range of accessibly priced EVs, with the first of these – the Model A – already on sale and priced from the equivalent of £24,000 before subsidies. We drove the car just before its official unveiling at the Shanghai motor show in March and, despite finding it short on thrills, were impressed by its finish and quality. A wider range of Geometry products are coming, and European sales are part of the plan.

Buying success

The other side of Geely’s growth strategy has been a dramatic series of expansions beyond the Volvo purchase. Geely bought a minority stake in taxi maker LTI in 2009, but then took control of most of its assets and production when it went into administration in 2012. The new company was rebranded the London Electric Vehicle Company with the range-extended electric LEVC TX cab launched in 2017 and plans to use this platform as the basis for a host of other models.

Then, two years ago, Geely moved to purchase a 49% stake in Malaysian maker Proton, and a majority 51% in its Lotus subsidiary. The strategic logic behind the Proton move was obvious, giving Geely access to the heavily protected Malaysian market but also extra capacity for right-hand drive production. Lotus seemed like a less obvious target given the brand’s minimal sales, but it soon became clear that – as with Volvo – Geely was planning to give its new subsidiary both investment and a large measure of independence.

Geely also built an investment in Daimler, ending up with a stake of 9.69% – enough to trigger concern in the German press about what the Chinese company wanted in exchange for its cash. A full-scale technical alliance hasn’t happened – at least, not yet – but in March it was announced that Geely had taken a 50% stake in Smart with plans to produce a new generation of entirely electric models in China.

The current Geely GE saloon introduced a new radiator design for the brand with a series of concentric rings known as the ‘expanding cosmos’ treatment. Design director Peter Horbury admits it was inspired directly from a conversation with Li himself. Given Geely’s dramatic growth in the two decades since it started making cars, it seems unlikely that Geely’s universe will stop expanding any time soon.

The future

Ambition has been Geely’s defining characteristic since it was founded. Autocar was among a small group of journalists who interviewed Geely Auto CEO (and Geely Group president) An Conghui at this year’s Shanghai motor show, where he made it clear that the company still sees plenty more opportunity for growth.

“Geely’s ambition is to become a world-class and globally competitive OEM and also OEM group,” he said. “We are doing this from both sides, working on our own and also realising this through collaboration with partners.”

The official plan is to grow the current brands rather than acquire new ones – “we will work on cultivating our own,” said An – but, based on previous form, we wouldn’t be too surprised to find Geely expanding further if the right offer came along.

Unsurprisingly, An sees electrification as both a technical challenge and an opportunity. He confirmed that Geometry models will ultimately be offered around the world – “We aimed it to be a global brand offering global products, to private car owners but also mobility providers” – and also that Tesla was both an inspiration and a target. It’s a broad hint that we can expect to see more powerful and expensive Geometry models overlapping with the lower reaches of the Tesla hierarchy.

Like many big makers, Geely Group is developing a pure electric platform called PMA – developed from CMA – which will be used to underpin Geometry, Lynk&Co, Volvo and possibly even Lotus models. While An said that some battery cell development is being done internally, largely for the brand’s commercial models, most batteries will come from the market, which Chinese suppliers are already leading. “On Geometry, the battery cells come from CATL,” he said. “We have already entered a joint venture with them. Going forward, the main part of our cells will be acquired through this kind of collaboration.”

An politely refused to put numbers on Geely’s long-term aims. Company insiders say the senior leadership are inspired by Toyota, but also the rapid growth of Hyundai–Kia. We would be surprised if the company doesn’t break into the global top 10 of car makers relatively soon, although An remains modest.

“Globally, Geely is still a small OEM group,” he said. “We look at the other OEMs in the world and find that each one has good aspects that merit learning from. We will continue doing the benchmarking we do, and we will continue to learn from the best practices of these other OEMs.’

Lynk&Co goes motor racing

Manufacturers using motorsport as a showcase for its wares is a concept as old as the car itself. But it’s not often a brand goes motor racing before its models are available to the public, as Geely has with Lynk&Co.

The programme to run a four-car super-team in the FIA World Touring Car Cup has meant Lynk&Co’s 03 TCR saloon, which is already on sale in China, has become familiar to European motorsport fans long before it will be seen on our Western roads. Swedish-based Cyan Racing, which previously ran Volvo’s Polestar S60 entries in the old World Touring Car Championship, runs the programme in a series that races in Europe for the first half of the season, then switches to Asia for rounds in China, Japan, Macau and Malaysia.

So far, it’s going pretty well – hardly a surprise given Cyan’s reputation and the quality of the drivers: the line-up includes three who share eight WTCC titles between them. After five triple-race weekends, Sweden’s Thed Björk is third in the WTCR points having already notched up three wins. Damien Smith

There’s also a flying car…

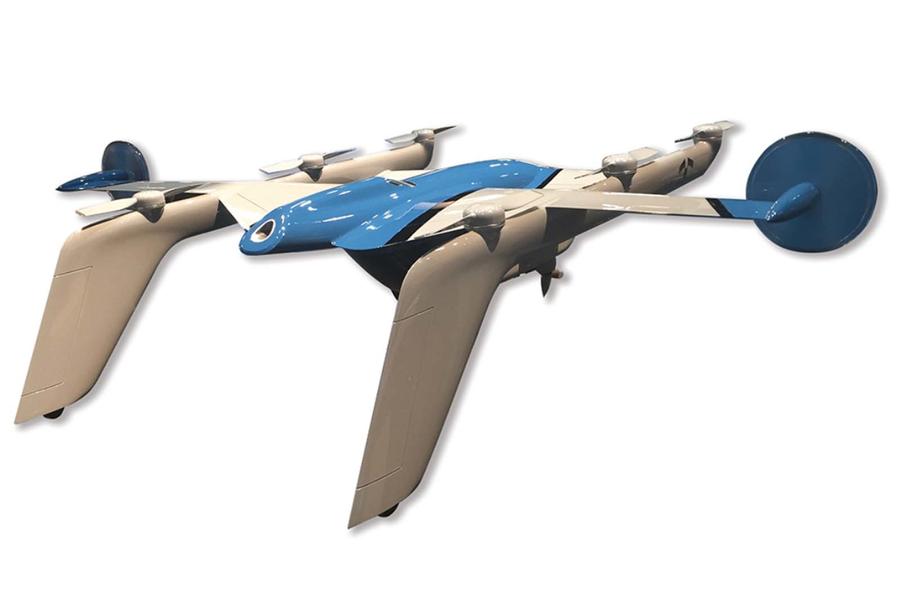

In addition to Geely Auto and Volvo Car Group, Zhejiang Geely has three other divisions. Mitime Group runs three universities in China and has built various sports facilities, including race circuits; Geely New Energy Commercial Vehicle Group contains both LEVC and the Yuan Cheng commercial vehicle division; and Geely Technology Group includes Quanjiang motorcycles, the Uber-ish CaoCao ride-sharing app – and Terrafugia, the flying car start-up that Geely took control of in 2017. Projects include the TF-2, which uses a passenger cabin that transfers between a road vehicle and an autonomous aircraft.

The transformation of Lotus

When Geely bought its stake in Proton from DRB-Hicom, Lotus seemed to be a much smaller part of the deal. But Geely insiders confirm that Lotus was seen as hugely attractive, both because of its history but also its engineering expertise.

Group Lotus CEO Feng Qingfeng confirms the brand will be used to develop and use pioneering technology before it appears elsewhere in the Geely family. That’s one reason why the forthcoming Type 130 electric hypercar will have significantly more performance than Volvo’s Polestar 1. Lotus engineering will be used to help develop new models, the first of which will include a heavily revised Evora, but also be available to the rest of the group.

The new engineering and design centre near Coventry will be mostly used for work on forthcoming Lotus models, including at least one SUV. “The Geely Holding Group is already reaping some initial benefit from Lotus engineering in terms of lightweight structure, aerodynamics and driving dynamics,” Feng told Autocar in Shanghai. “We already see value, but this is still the early phase – there is more to come.”

Read more

Geely launches EV brand Geometry with Tesla Model 3 rival

Why Chinese firm Geely has made a Smart investment

Lotus models to be built in new China factory

Source: Autocar