The Volkswagen Group had the largest market share in Europe from January to May 2023, but cut EV production

Inflation might combine with increased new car prices and other factors to cause a “bleak” second half of 2023

Car sales are jumping across Europe as supply returns, new figures show, but high new car prices and rising interest rates threaten the industry’s recovery in the second half.

Overall sales across Europe, including the UK, grew by 17% to 5.3 million in the first five months of the year, according to data from European automotive industry group the ACEA. Within that, the UK followed the European average with a 17% increase to 772,454 over the same period.

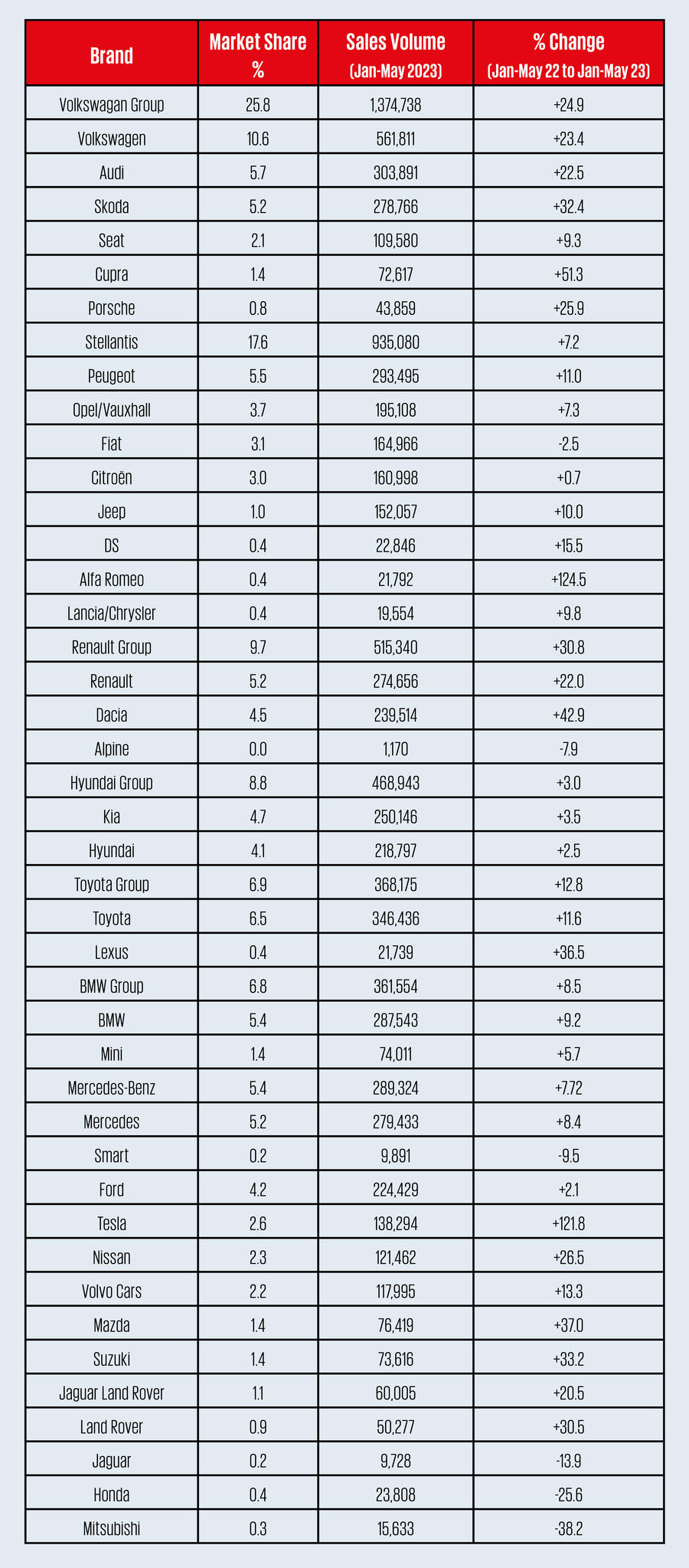

Sales numbers across the car makers tell a very different story from this time last year. Then just eight out of the 34 brands listed by the ACEA were able to grow sales across the first five months compared with previous year (itself disrupted by the pandemic).

This year, the much rosier ACEA data showed the reverse of that, with only six brands (including Fiat, Honda and Mitsubishi) unable to improve on 2022 figures. Volkswagen remained the biggest brand with sales up 25%, reflecting its dismal time during last year’s supply crisis, while Toyota was second, up 12%.

Electric vehicles were the big winner, with sales jumping 42% across all markets for a 14% share. Hybrids, up 26%, also outpaced the market to grow at a slower pace than EVs but occupying a bigger share of just over a quarter of the market (the ACEA includes mild hybrids in its hybrid data). Plug-hybrid sales fell slightly to just 7.1% of the market, while diesels also continued their slide to hit 13% of the total.

Analysts, however, remain cautious as to the quality of the recovery, pointing out that many sales in the first five months were fulfilling the backlog that has built up over the past year or so. “The underlying demand backdrop still remains challenging,” Sammy Chan, a senior analyst at LMC Automotive, told Autocar.

Government actions to try to keep a lid on inflation is increasing interest rates, making cars more expensive to finance. Record car prices mixed with a high cost of borrowing will suppress sales even as cars become more available. “We forecast slower growth in the second half of the year compared to the first,” said Chan.

Suppliers, often the canaries in the car market coalmine, flagged the dangers in the second half. One such supplier is seat maker Adient, whose CEO Doug Del Grosso described the outlook for European car sales in the second half of the year as “bleak” in his most recent earnings call back in May.

The Volkswagen Group has scaled back EV production in Europe. Shifts at VW’s Emden plant in Germany have been cut, affecting the ID 4 SUV and the new ID 7. Manfred Wulff, head of the works council for the Emden plant, told the North West newspaper: “We are experiencing strong customer reluctance in the electric vehicle sector.”

VW’s actions, whether linked to a downturn in the popularity of its cars or the EV sector in general, are a reminder that car makers have become increasingly reluctant to switch to their old model of pushing sales through discounts.

VW Group CEO Oliver Blume recently told investors that his company was now wedded to the ‘value over volume’ principle. “Our new steering model of Volkswagen Group will prioritise sustainable value creation over a focus on volume growth in the past,” he said.

Back in the old days, VW would “focus on outgrowing fixed costs to increase profitability”, said Blume. That meant boosting production to the point that sales would cover the German company’s huge bill for labour, development, marketing and other general expenditures, however thin the final margins.

The car makers during the pandemic and subsequent parts shortages had pricing discipline imposed on them as customers struggled to get hold of new cars, allowing them to raise prices. The average price of a new car sold in the UK has risen by almost £6000 to £45,311 between January 2021 and today, What Car? data shows. Meanwhile, the average cash discount fell 36%, while PCP finance discounts dropped by 32%.

Despite the ‘value over volume’ pledge from the likes of VW, Stellantis and others, discounts are improving. What Car? shows discounts have increased 12% to £1500 on average from 1 January to now, with PCP discounts up 14% to £2048.

Car makers, however, are still facing brakes on their ability to supply cars, aside from self-imposed stoppages to avoid an oversupply. Parts shortages are still an issue, if less than they have been, while logistics problems are conspiring to keep cars in factories and ports. “The pent-up demand for vehicles is only slowly moving through the process chain,” said VW Group chief financial officer Arno Antlitz at the group’s recent investor day. “Currently the bottleneck has reached the entire logistics chain.” He cited a shortage of trucks, trains and ships and the people needed to drive or offload them.

Stellantis has been hit hard by logistics problems, which is partly the reason why its market share has fallen to 17.6% for the first five months, from 19.2% over the same period last year.

European sales numbers, however, will ultimately beat those of 2022, predicts LMC, finishing at 16.1 million up from 14.6 million last year, while a better economic situation into next year will see further rises in 2024 to 17.6 million and onto 18.9 million in 2025, the company predicts.

Source: Autocar