Estate fans are celebrating the return of the V60 and V90 but SUVs have slowed the wagon’s roll in Europe

News that Volvo will revive sales of estate cars in the UK after cancelling them last year has gained huge traction both inside and outside the automotive media, possibly driven by those who still prefer estates to the now-dominant SUV bodystyle.

Volvo told Autocar it had brought back the V60 and V90 estates “due to the resurgence for our estate products in recent months”, but what is the full picture of the estate car market in the UK?

Firstly, estate cars have indeed made a resurgence in the UK this year, with sales in the UK rising 16% in the first four months of the year to 25,311, according to figures from market researcher Dataforce.

That’s nearly double the rise of the overall car market, which grew 8.4% in the same period.

The UK’s increased appetite for estates has increased slightly faster than demand for the bodystyle across the rest of Europe, where it grew 15%.

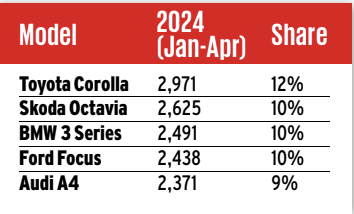

The UK’s best-selling estate in the first four months was the Derby-built Toyota Corolla Touring Sports, at 2971 units – enough to take a 12% share of the market.

The Corolla edged out the second-placed Skoda Octavia estate, the car has that consistently dominated the overall European estate charts and continues to do so this year, according to Dataforce.

Top estate models in the UK, Jan-April (Dataforce figures)

The fear for estate aficionados has been that the move to EVs would freeze out the bodystyle for good, as brands simplify their ranges to help cut soaring development costs.

For a while, the MG 5 was the only electric estate available, but we now have EV versions of the Vauxhall Astra and Peugeot 308 estates plus the imminent Volkswagen ID 7 Tourer. European market leader Skoda has promised an EV estate while MG has said it will make a longer version of its successful MG 4 to replace the ageing MG 5.

Upcoming premium brands offerings, meanwhile, include the BMW i5 Touring, Nio ET5 and forthcoming Audi A6 E-tron Avant.

Estates make a strong case for themselves in the EV era, given that their lower height creates less air resistance and thus improves range.

However, to say we’re in the middle of an estate renaissance might be stretching reality too far.

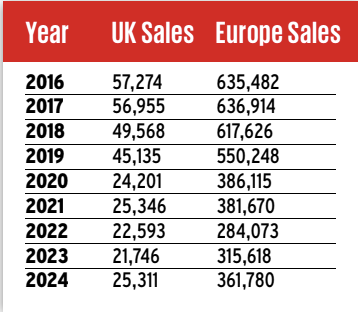

So far this year, the estate share of the overall car market in the UK was still just 3.7%, less than half the European average of 8.0%. Despite the boost in 2024, we’re still buying fewer than half the number of estates we were in 2016, according to Dataforce.

Long term estate decline in the UK and Europe (Jan-April, Dataforce figures)

“Manufacturers are focusing more and more on SUVs, so a trend reversal is not to be expected,“ said Dataforce analyst Benjamin Kibies.

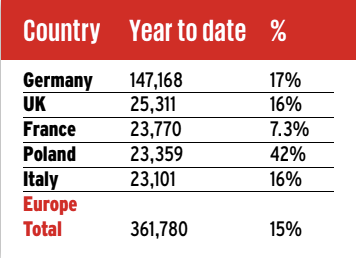

That manufacturers still develop estates at all is mainly due to continued strong demand in Germany, the market that consumed almost half of all the estates sold in Europe in the first four months this year.

The market share for estates in Germay was 16%, double the European average. Only the Czech Republic, Finland and Sweden love estates more, based on the market share in those countries for the first four months.

A healthy market in Germany means car makers there can afford to develop estates and spread them around to markets that in the main aren’t that bothered. In the first four months of 2024 in the UK, Audi was the biggest seller of estates by brand, with just 3330 cars, mainly the ageing A4.

Europe’s biggest estate markets Jan-April show revival (Dataforce figures)

Sweden has shifted its allegiance more towards in SUVs in recent years, but its estate market share of 17% this year still drives Volvo sales and hopefully future estate development from the brand.

While the returning Volvo estates are still attractive from a design perspective, they’re now long in the tooth: the V90 was first launched in 2016 and the V60 in 2018. Their age means they’re unlikely to set the charts alight next to the new BMW 5 Series Touring, for example, or even the new Volkswagen Passat (now only an estate) and Skoda Superb estate.

Meanwhile, popular estate models continue to head into extinction. The mid-size market, once dominated by the Ford Mondeo and Vauxhall Insignia/Vectra, is now kept alive by the Passat and Superb, with minimal support from the Peugeot 508. At the end of next year, Ford will axe the fifth-placed Focus hatchback and estate.

The supermini estate segment, meanwhile, has all but disappeared, with just Skoda’s Scala – a stretched Fabia – keeping the flame alive.

In the battle for weight saving and range, the low-slung estate is the perfect weapon to deploy. But the war may have already been won, with the SUV standing triumphant.

Source: Autocar