Autocar found a 2023 Nissan Leaf with 1500 miles listed for £13,999

Cost of nearly-new electric cars is in freefall as dealers try to stimulate demand

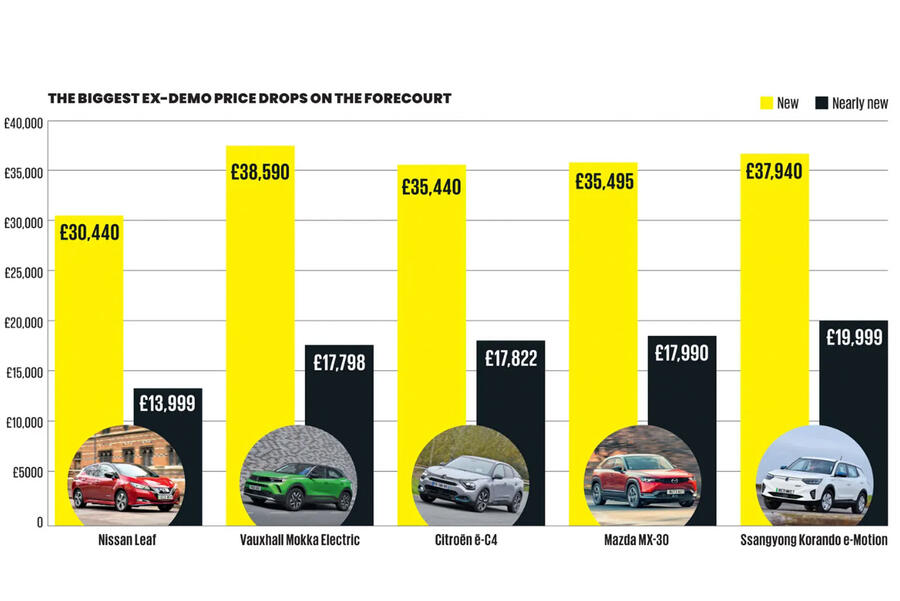

Dealers are offering discounts of more than 50% on ex-demonstrator electric cars as they battle slowing demand.

The incentives mean that low-mileage examples of EVs such as the Nissan Leaf and Vauxhall Mokka Electric can be bought for less than their nearest petrol-powered equivalents with similar mileage.

They are being offered in part to ensure the ex-demo EVs undercut new models, which are also being offered with sharp discounts to boost sales as manufacturers try to hit their zero-emission vehicle (ZEV) mandate targets.

There is also a supply-and-demand factor: because tax incentives encourage company car buyers – which account for the bulk of EV sales – to opt for new cars, there is still only a limited market for used EVs. Yet there is a large amount of stock, owing to the volume of pre-registered EVs.

Autocar found a 2023 Leaf N-Connecta with 1500 miles listed at a dealer in Belfast for £13,999, a 54% reduction on its list price of £30,400.

Meanwhile, a 2023 Vauxhall Mokka Electric Ultimate with 1800 miles was available at a Great Yarmouth dealer for £17,798 – also down 54% on list.

As for ICE models, a 2023 Nissan Qashqai with 3800 miles was offered for £22,911, reduced by only 27%, while a 2023 Mokka Ultimate that had covered just 2500 miles was £20,990, down 29%.

This drastic drop in prices of nearly new electric cars comes as manufacturers also push sales of new EVs in order to hit government-imposed emissions targets and thereby avoid big fines.

Major manufacturers have introduced enticing incentives to stimulate sales of their electric models. Skoda, for example, is currently offering 0% APR finance and large deposit contributions on brand-new Enyaqs. Terms for an Enyaq through Skoda’s approved-used programme typically range from 11-15% APR, with deposit contributions of up to £1000.

According to Chris Plumb, an EV specialist at Cap HPI, it is “very difficult” for dealers to know where to price nearly new EVs in order to generate interest, given the pressures on manufacturers to sell the new EVs that count towards the ZEV target (this year it is 22% of total sales).

Plumb added: “The new car offering and the new car discounts available make it more attractive for the consumer to take the new car over that 12-month-old product in the market.”

Car makers have also started to squeeze deliveries of ICE cars in order to hit EV sales targets. This is affecting car dealers’ stocks, according to Vertu Motors boss Robert Forrester. “We can’t supply the cars that people want, but we’ve got plenty of the cars that maybe they don’t want,” he told The Daily Telegraph.

Plumb told Autocar it takes an average of 46 days to sell a six- to 12-month-old electric car, while the equivalent petrol car takes 33 days, so lowering the cost barrier is key. Three- to four-year-old EVs (which are significantly more affordable) take an average of 31 days to sell, which is quicker than comparable petrol models.

Dealers will be hoping that by gradually ramping up discounts on the nearly new stock, the gap will narrow.

Source: Autocar