The car industry was propelled to the top of the news agenda in 2023, writes Felix Page

So, 2023: the year we forgot about Covid, electric cars slipped inconspicuously into the mainstream and we could barely move for enormous piles of worthless semiconductors – a world away from the turbulence and uncertainty of 2022.

Well, not quite. While the past 12 months felt relatively stable and established a sense of optimism within the car industry going into 2024, it was the direct opposite of uneventful, and it will surely be written into the history books as a transformative year for motoring.

Since the dawn of the car, there has surely never been less of a divide between the industry and the wider news agenda, nor has the car ever been so central to popular discourse, not to mention politics at national and global levels.

A Hillingdon to die on

It began in a leafy suburb of West London on 20 July, as Conservative candidate Steve Tuckwell claimed a narrow victory over Labour’s Danny Beales in the Uxbridge and South Ruislip by-election, off the back of a “one-issue campaign” that revolved almost exclusively around his opposition to London mayor Sadiq Khan’s expansion of the capital’s Ultra Low Emission Zone (ULEZ).

Many constituents, incensed at the prospect of paying £12.50 a day to drive their cars within the M25, loudly engaged with Tuckwell’s chest-thumping ‘Stop ULEZ’ agenda, and so this minor by-election ultimately became the kindling that would light a roaring bonfire (or should that be bin fire?) of debate around the very concept of personal mobility.

In a bid to recapture some sorely needed populist appeal, Tory prime minister Rishi Sunak jumped on the bandwagon and quickly introduced 20mph speed limits, and reduced the fine for stopping in a yellow box junction.

It would all culminate in the shock postponement of the UK’s world-leading ban on selling new ICE cars. Sunak moved it back from 2030 to 2035, in the process no doubt winning the hearts and minds of many an EV sceptic and making the humble combustion engine central to his party’s prospects of success in the 2024 general election.

Welcome to a new ICE age

Meanwhile, over on the mainland, a battle raged all year between European Union lawmakers – who said ICE cars had to become cleaner to use – and car makers, who said it would be pointless to impose huge investment into lowering tailpipe emissions while they were working hard to replace fossil fuels with zero-emission systems anyway.

The bone of contention was the planned onset of strict new Euro 7 emissions regulations, which would have necessitated fitting costly new electronic catalysts and data-capturing hardware to each new ICE car.

The implications were huge, with small, affordable models like the Volkswagen Polo and Skoda Fabia facing early retirement because they could no longer be sold profitably. Volkswagen brand CEO Thomas Schäfer estimated the new tech would have added as much as €5000 to the manufacturing cost of each car.

But then a shock: the European Parliament backed calls from the industry to tone down the requirements, and so (assuming that the European Commission ratifies the changes) Euro 7 is now set to be scarcely more punitive than the current Euro 6 framework.

Heavy goods vehicles and buses will still face tougher tests, and MEPs say there should be more of an emphasis on testing particulate emissions from tyres and brakes, but the move could be no less than a lifeline for the affordable ICE car.

Skoda CEO Klaus Zellmer told Autocar that the “more realistic” regulations had “extended the potential life cycle” of the Fabia and even suggested another entire model generation could be possible. Did Ford kill the Fiesta too soon?

Mass appeal

The car was invented in the Victorian era, but it wasn’t until the likes of the Fiat 500, Volkswagen Beetle, Citroen 2CV and BMC Mini arrived several decades later that the European masses were able to take to the open road. It was then that the idea of owning a car truly became an attainable prospect for millions – and that’s about to happen all over again.

Because electrification is such an expensive game, the first wave of mass-produced EVs has been disproportionately skewed towards the premium end of the spectrum, and there hasn’t yet been any real penetration below the £25,000 mark – but many manufacturers are now in a position to reverse that trend and a new age of the people’s car beckons.

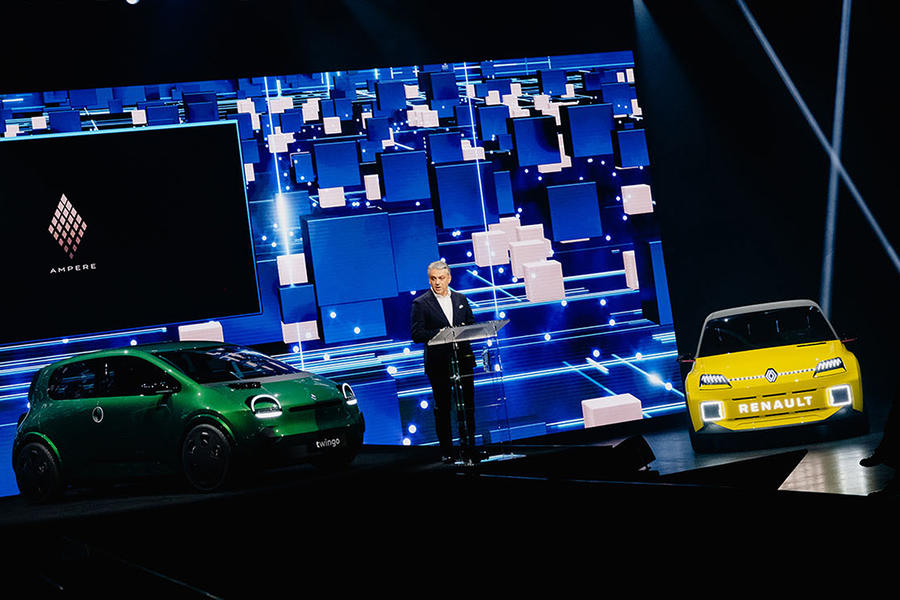

In 2023, Volkswagen said it was working “flat out” to make the £17,000 ID 1 a reality and Renault revealed an electric take on the Mk1 Twingo that should reach showrooms at around the same price in 2026.

So too has Opel-Vauxhall hinted at plans for a new city car to sit underneath the Corsa, and while Dacia hasn’t put a price on its upcoming electric Sandero, the use of amortised Renault underpinnings and potentially sodium-ion batteries could make it as cheap as today’s petrol model.

China make some sense of it all

The 2022 version of this story referred to Stellantis CEO Carlos Tavares’s wish to see the EU impose tariffs on Chinese-made cars in a bid to stop established European firms from losing ground to newcomers like BYD, MG, Nio and many more.

This year, that view was contrasted by his Renault Group counterpart, Luca De Meo, who is of the more capitalist opinion that these Chinese disruptors deserve to compete in the European market on merit and companies like his own stand to learn a lot from their approach to gaining market share.

“The only thing we can do is to accept that, to actually look at them and be humble, but not play the victim,” he said.

The sticking point is that as the European car industry gets back on its feet in the wake of the Covid pandemic and semiconductor crisis and in the face of huge geopolitical uncertainty, its brands have to square off with Chinese rivals that enjoy the enormous advantages of substantial state subsidies, cheap manufacturing costs and stable local supply chains.

However, de Meo’s opinion is rooted in recent memory, as he likens today’s uneasy competitive environment to those from the 1960s through to the 1990s. “When the Japanese and Koreans came, it was the same thing” he said. “They can play the game.”

“If you sum up all the non-European brands in Europe, [their market share is] 25%, not 95%,” he added, concluding that “there’s no reason why we shouldn’t allow people who do good stuff for the European consumer to enter the market, to offer people what they want.”

British industry rises from the ashes

For a long while, it looked like a perfect storm of Brexit, Covid and a global supply chain meltdown had battered the British automotive industry so badly that it could never recover.

The bad news just kept coming: Nissan changed its mind about building the new X-Trail in Sunderland, Honda closed down Swindon, Ineos swapped Grenadier production from Wales to France and Dyson’s plan to build a Tesla Model Y rival ran out of road.

With all that added to the long and laboured demise of Britishvolt, domestic car production falling to a half-century low and the imposition of costly new decarbonisation initiatives and trade rules, the outlook became bleaker by the day.

But then the wind changed direction: in the space of a few months, we had confirmation of two new electric Mini models to be built in Oxford, a range of electric SUVs for JLR’s Halewood factory and – perhaps most significant of all – Nissan’s allocation of no fewer than three new electric cars to its Sunderland factory.

In more recent months, an uptick in consumer demand has fuelled a huge spike in the UK’s new car output and the local battery supply network has been boosted by significant commitments from Nissan and JLR parent firm Tata.

Two unignorable questions remain, however. Will the UK’s domestic battery supply network grow to a suitable scale to support the electrification ambitions of its car makers?

And will there be enough demand for electric cars themselves to sustain the entire framework? Next year will be a decisive one, but the clouds that long loomed overhead are quickly blowing away.

Source: Autocar